London, May, 2011 – The global armored vehicles and counter IED vehicles market is expected to record decline from 2011–2021 due to the end of military operations in Afghanistan and Iraq in this period. As a result of Western austerity and high levels of fiscal debt in the West, defense modernization plans have overwhelmingly been postponed to contain fiscal expenditure. In Asia, defense expenditure and modernization is set to increase due to China’s large defense expenditure increase and territorial disputes within the region. However, despite North America’s high levels of fiscal debt, this region will constitute the largest share of the global market from 2011–2021.

|

Global armored vehicles and counter IED vehicles market to decline

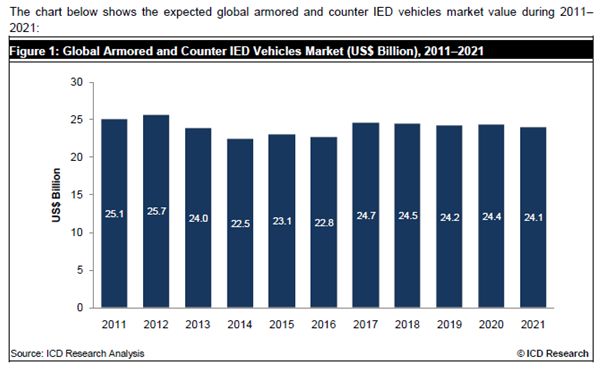

In 2011, the global armored vehicles and counter IED vehicles market valued over US$25 billion. However, the market is expected to decline from 2011–2021 as military operations in Afghanistan and Iraq are expected to end in this period. In line with this expectation, the market value is expected to fall by around US$1 billion by 2021, with a cumulative value of over US$250 billion from 2011–2021.

North America to constitute largest market share

Despite the high fiscal deficit of North American countries, from 2011–2021 these nations will constitute over 30% of the global armored vehicles and counter IED vehicles market, which is the largest market share. Europe is expected to account for around a quarter of market share from 2011–2021, but demand for armored vehicles in this period will decline. In contrast, Asia will increasingly require armored and counter IED vehicles to combat territorial disputes and to cater to the large troop size of regional forces. Additionally, soaring oil prices and economic development in the Middle East will increase demand for armored vehicles from 2011–2021, and the discovery of oil and mineral resources in Africa, along with ethnic and territorial disputes, will increase demand for armored vehicles in this region. Although South American countries plan to modernize their armed forces, this modernization is only expected for air and navy forces, and therefore demand for armored vehicles in this region is expected to decline from 2011–2021.

Infantry fighting vehicles (IFV) and armored personnel carriers (APC) account for largest market share

Collectively, IFVs and APCs are expected to account for the largest share of the global armored vehicles and counter IED vehicles market from 2011–2021. Increasing global troop sizes and overseas operations are expected to increase demand for tactical trucks and light multirole vehicles (LMV). However, the end of military operations in Afghanistan and Iraq, coupled with the integration of mine protection technology in all other classes of vehicles, will result in mine resistant ambush protected (MRAP) vehicles contributing just over 5% to the global market from 2011–2021. Increasing global demand for armored and counter IED vehicles will come from overseas peacekeeping missions, territorial disputes, military modernization programs and internal insurgencies faced by some countries.

Technological innovations enhance capabilities of armored vehicles

Modern armed forces must keep up with technological advances and changes to threats, terrains and tactics in order to effectively cater to modern warfare. This has forced many militaries to modernize their fleets with technology to ensure survivability, connectivity, mobility and lethality. Armed forces must balance protection, payload and performance with improved vehicle efficiency while inventing ways to reduce operational and through-life support costs.

Western austerity to encourage consolidation

Defense cuts by Western governments, combined with the high cost of developing technologically superior weapons platforms, have encouraged consolidation amongst governments, services and industries. This has led to domestic and international consolidation through joint development and procurement programs, which are expected to continue from 2011–2021.

Modernization delayed in Europe but increasing in Asia

European countries such as the UK, France, Germany and Spain have postponed defense modernization due to the recent economic crisis, which resulted in high levels of fiscal debt. As a result, European countries have postponed modernization plans to contain fiscal expenditure and are exploring options for joint procurement and equipment development.

However, defense modernization in Asia, which primarily consists of India, China, Japan and South Korea, is leading to an increase in global defense capital expenditure. China’s significant increase in defense expenditure has led to an imbalance of power in Asia, and other Asian countries have been forced to increase their defense expenditure. The alleged nuclear aspirations of North Korea and territorial disputes between Thailand, Malaysia and Singapore also contribute to enhanced defense expenditure and modernization in Asia.

Here you can find more information about: The Global Armored Vehicles and Counter IED Vehicles Market 2011–2021

About ICD Research

ICD Research is a full-service global market research agency and premium business information brand specializing in industry analysis in a wide set of B2B and B2C markets. ICD Research has access to over 400 in-house analysts and journalists and a global media presence in over 30 professional markets enabling us to conduct unique and insightful research via our trusted business communities. Through its unique B2B and B2C research panels and access to key industry bodies, ICD Research delivers insightful and actionable analysis. The ICD Research survey capabilities grant readers access to the opinions and strategies of key business decision makers, industry experts and competitors as well as examining their actions surrounding business priorities.

von

von